Joe Worries About Retirement Savings

Plan A for Retirement Savings

Meet Joe Fretful. Joe worries about his retirement savings. You can follow Joe’s retirement savings story in the video below or read along

You see Joe has been working for over 30 years on his Plan A. He is happy to see that his savings are above the national average. But he has seen reports that he needs to have $1 million saved by the time he retires. He also read that at age 50, he should have saved 6 times his average salary – around $318,000 (based on an average 50 year old’s salary). Well Joe worries that he might just not make it or have enough.

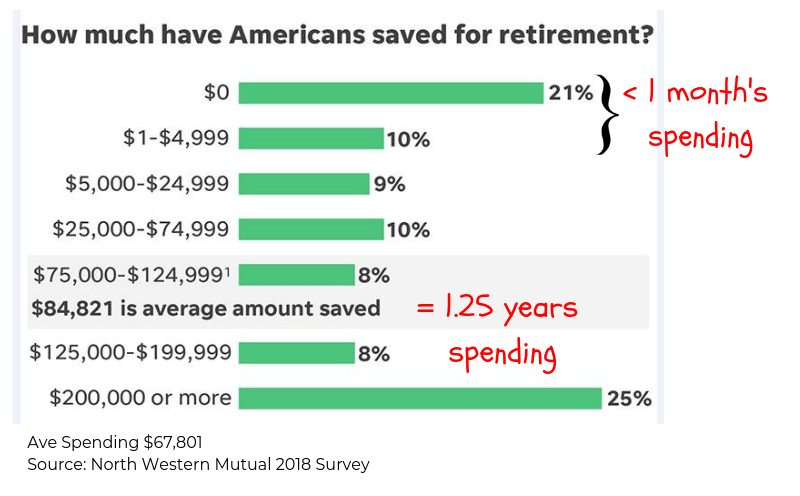

US Retirement Savings

Joe is not alone. 30% of Americans have less savings than one months’ spending. Worse still, fully 64% have less than 3 years spending saved. In fact only 1 in 4 Americans have more than 3 years worth of spending saved. These are the averages – 1 and a quarter years spending in average savings. The charts look a whole lot worse for younger Americans, whether Gen X or Millennials.

Source: North Western Mutual 2018 Survey

New data out from U.S. Government Accountability Office says 48% of those 55 and older have no retirement savings . Two in five households do have access to a traditional pension plan. Social Security provides most of the income for 50% of households over 65 years of age.

Source: Bloomberg.com

Working Out How Much Retirement Savings

Working out what Joe needs for retirement savings is a little tricky. Joe has to guess what spending will be, how long he will live and what investing returns will be. So we have to make some big assumptions as we build the estimates. One model is to look at what your annual spending is currently and apply the 4% rule for how much is safe to draw from savings if you are preserve your capital. To deliver $50,000 of spending at the 4% rule, Joe needs $1.25 million of capital. (Joe divides $50,000 by 0.04) The 4% rule has been around for a while now. Start by taking 4% of your savings in the first year and keep at that level but adjusting for inflation (so you can keep up with it). Funds should last 30 years – all other things being equal.

Back to Joe’s story

Planning for Retirement Savings

Planning for retirement savings is best done early on to give compounding a lot of time to work and also to give time for recovery if something goes wrong. Joe has worked really hard on his Plan A to get himself in place. These are the things that have worked for Joe

- Completed school and college to build a good foundation

- Found a solid job

- Kept growing his skills to build a great career

- Saved to buy his own house

- Saved wisely to build some capital

- Invested well with a growth model but not too risky

- Helped his children get onto their own Plan A – finish school and get qualified for a skilled job

Joe sure hopes that his Plan A will provide a great retirement funded by

- His savings

- His home (partly paid off)

- A small inheritance from his parents

- His company pension

- A government social security pension

Joe knows he should be careful with his spending but he also knows that winning the lottery would help a lot as a big bonus to his retirement savings.

Threats to Retirement Savings

The headlines scream at Joe every day about all the things that could go wrong: Yikes!!!! Here are few from this week:

- Lose his job

- Changes in health

- Rising medical expenses

- Paying off college loans

- Falling investment returns

- Market crash (property and/or stocks). Remember 2008 and 2000. Joe does.

- Rises in taxes

- Cuts in social security pensions

- Living longer than expected

- A calamity that drives up costs – like an auto accident or house fire or something else yuk.

I feel for Joe. I am dependent on markets to supplement my Plan A. These headlines bother me, big time. Find the story here about my number

Building a Stronger Plan A

Joe has spent some time with his accountant. They have talked about changes to Plan A – make a stronger Plan A. There is a lot Joe can do. Spend less. Work longer. Send his wife to work. Move to a cheaper location or a smaller house. Do stuff on the side.  You know that 12% of Americans have a side hustle – that is 1 in 8? And side-hustles seem to be getting easier and more available – part time work, surveys, product testing, blogging, Youtube videos, selling stuff, driving Uber or Lyft, AirBnB, and more. Joe Googled “side hustle” and found heaps of blog posts – each one an example of a side-hustle. Write up what works and get paid by advertisers or referrals.

You know that 12% of Americans have a side hustle – that is 1 in 8? And side-hustles seem to be getting easier and more available – part time work, surveys, product testing, blogging, Youtube videos, selling stuff, driving Uber or Lyft, AirBnB, and more. Joe Googled “side hustle” and found heaps of blog posts – each one an example of a side-hustle. Write up what works and get paid by advertisers or referrals.

Putting all those things together and Joe just feels that he cannot make it work. He needs something more. He needs a mega side-hustle. His mates have shared their ideas – they are all into something. It all looks like a bit of a hustle game – not called side-hustle for nothing.

Source: Entrepreneur.com

Plan B for Retirement Savings

Joe has big ideas too – maybe it is time to build a Plan B. Some big arenas Joe has looked at:

- Trading – forex, binary options, options, penny stocks, stocks. They require a lot of expertise. It takes time to get any good, there are lots of scammers in the sector too. What really bothers Joe is the numbers just do not stack up. He has to put a lot of capital at risk to get 1 or 2 percent a month. Too hard.

- Bitcoin caught his eye. Mining, trading, investing – all seemed to offer crazy returns in 2017 – then it all seemed to go pear-shaped. And then there is a fair share of scammers too who brazenly ignore the rules and then the cease and desist letters begin to flow. Joe has seen a few of those.

- A few of Joe’s friends are pushing their network marketing businesses – the so-called MLM’s (multi level marketing). Get a few friends hooked in and earn a share of income as they build a pyramid or matrix of sellers underneath them. Been a few scammers running around doing this too, Joe hears from his other friends (many of whom have lost a bundle).

- Maybe the way to do a proper Plan B is to start a business – a business that Joe can control and manage and does not depend on other people selling for him or for deploying capital and carrying any type of market risk.

Joe fancies the idea of finding something he could start part time for a few hours a day and at weekends. Then if he sees it working really well, he might even give up his job. Of course, his wife, Martha, could help too.

Physical Products vs Digital Products

Joe has thought about this quite a bit – he has split it into two types of business – one selling physical products and the other selling digital products and/or services. Joe worries about this. He has run some numbers about buying stuff from China and selling on Amazon and eBay. The numbers are big as he has to buy big quantities to get good prices – what happens if he cannot sell them? And Joe heard that Amazon keeps changing the rules of the game. Maybe Joe has to start his own store on eBay or using Shopify.

Now digital products make a lot of sense. No China. No drop-shipping. No warehouse and no customer returns. No inventory. Easy!!

Find something to sell. Promote it and away you go. Quite simple really.

Joe has spent some time on Google too to dig around a bit.

Source: DigitalVidya

Problem also is Joe feels he does not have the skills to cover half the things on the list from this one blog post. He is not that hot on the PC. He certainly does not have any product ideas – who wants a eBook on lawn maintenance or bass fishing – things he knows about? How much could he sell them for? He would need to find a shed load of customers to make that better than Plan A. Joe does not have a very big network and he feels his savings are not best applied to spending money on marketing and advertising. He knows nothing about marketing anyway. He is very wary of doing the selling that he feels would be needed. If it was that simple, why is the whole world not doing it? Joe thinks commissions are too small and there seem to be a lot of shady scammers around. It is all too hard.

Does this resonate? Plan B for retirement savings is going to take some breakthrough thinking or a big lottery win. Best buy a ticket, Joe. Be like Joe – think about retirement savings and start working on a better Plan A or a new Plan B

Credits

Stickman Image by Clker-Free-Vector-Images from Pixabay

1 Response

[…] is but not sure when. Key thing is I did get something up and it forced me to write a really good blog post about Joe’s retirement savings worries. Here it is […]